Definition of a freelancer under GST

There is no separate definition of a freelancer under the GST Act.

Any person who provides services to another person on a contract basis is known as a freelancer. They are not employed by a single company or an individual business owner — freelancers are self-employed and provide their services to several companies/ business owners simultaneously. Since freelancers are not regular employees of any organization, employment laws do not apply to them.

However, as service providers, freelancers fall within the ambit of GST provisions.

So whether you are a freelance content writer, a website designer, or a marketing consultant, you will fall under this category.

When should a freelancer get a GST registration?

GST registration refers to the process through which a taxpayer can register under GST.

A freelancer should obtain a GST registration once they meet the turnover threshold, as follows:

- If your turnover is more than INR 20 lakhs in a financial year (or INR 10 lakhs in the case of special category states), you must get a GST registration, regardless of where your clients are located.

If you provide services of less than or upto INR 20 lakhs in a financial year (or INR 10 lakhs in the case of special category states), you don’t have to get registered under GST mandatorily. This rule applies regardless of whether the services are being provided within the state where you are registered, another state, or outside India.

Freelancers providing services covered under Online Information and Database Access and Retrieval must also get a GST registration.

Advantages and disadvantages of GST

Here are a few advantages and disadvantages of GST in India at a glance:

Advantages of GST

- Eliminates the need for small businesses to comply with different indirect taxes

- Eliminates double taxation that increases the hidden costs of doing business.

- Minimizes tax evasion

- Mandatory registration linked to a higher turnover exempts a large group of service providers liable to pay VAT and service taxes.

- Service providers can claim input tax credit to reduce their tax burden.

Disadvantages of GST

- Business owners need to appoint tax professionals to ensure GST compliance. This increases operational costs.

- Registering under GST, raising invoices with the GST component included, and filing returns can be overwhelming and time-consuming.

What is the minimum limit for GST registration?

Registration under GST is linked to the annual turnover of the service provider.

There are two types of registration in GST:

Mandatory registration

GST registration is mandatory if:

- Your turnover exceeds INR 20 lakh in a financial year (INR 10 lakh in a financial year for special category states)

- You provide services covered under Online Information and Database Access and Retrieval services, such as advertising on the Internet, gaming services on the Internet, cloud-based services, selling e-books, music, or movies, etc.

- You are carrying out any inter-state supply of goods/services.

Special category states include:

- Uttarakhand

- Arunachal Pradesh

- Assam

- Jammu & Kashmir

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Sikkim

- Tripura

- Himachal Pradesh

Voluntary registration

If the annual turnover of a taxpayer is less than the limits specified above, they can choose to register under GST. Once registered, the taxpayer is subject to all GST provisions, including paying the applicable GST and filing returns.

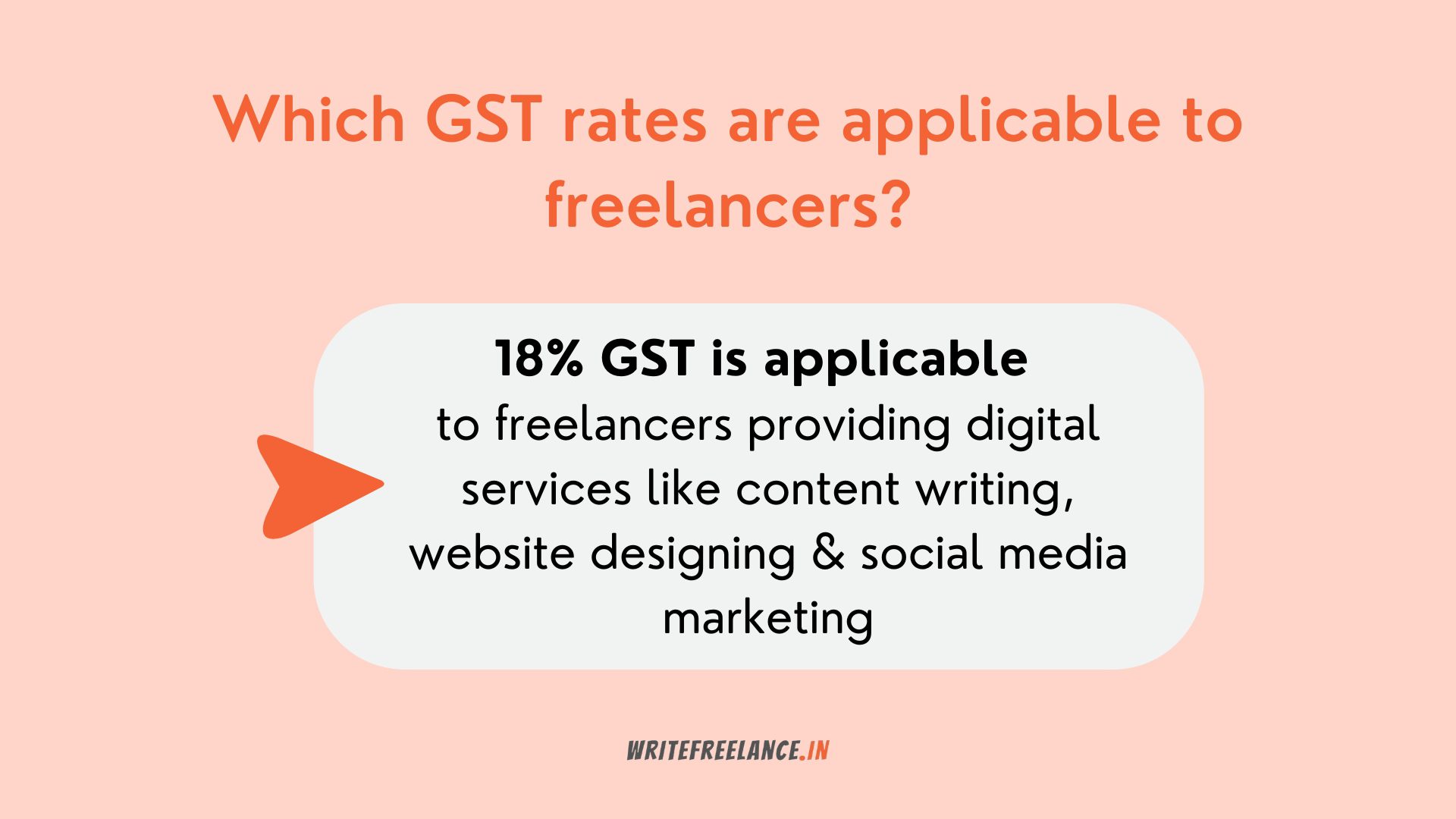

Which GST rates are applicable to freelancers?

The applicable GST rate depends on the type of service provided.

Currently, the GST council has categorized the various services provided in India into four slabs 5%, 12%, 18%, and 28%. There is also a nil-rated slab with a GST rate of 0%. You can use any GST rate calculator or visit the government website to find the applicable rate for your service.

While digital services such as content writing, website designing, digital marketing, and virtual assistance are not explicitly listed, all services provided via the Internet usually attract a GST of 18%.

Since 2019, the government has also launched a composition scheme for service providers with a turnover of less than INR 50 lakhs, where the GST rate is 6%. While some freelancers may benefit from the scheme, it can be challenging for content writers or digital marketers, as services provided to a person in a different state or country are excluded.

What is the process for GST registration for freelancers?

Registration for GST for freelancers can be completed online through the GST portal.

Here’s a brief overview of how to generate your GST registration certificate:

Part A

- Select the ‘New Registration’ option from the drop-down menu of the GST portal.

- Fill up the application form by entering the legal name of your business as indicated on your PAN card and the email ID of the authorized signatory.

- Click the Proceed button to begin the verification process.

- Enter the OTP received on your mobile number and email when prompted

- Once the OTP is verified, the portal will generate a GST Transaction Reference Number (TRN).

Part B

- Log into the GST portal and click ‘Register’ under the ‘Services’ menu.

- Click on ‘Temporary Reference Number (TRN)’, enter the TRN generated, and click the ‘Proceed’ button.

- Enter the OTP received on your email address and registered mobile number and click on ‘Proceed.’

- You will be able to see the status of your application. Click on the Edit icon to upload the documents needed for GST registration, as listed below:

- Photographs

- Proof of business address

- Bank details (account number, bank name, bank branch, and IFSC code)

- Authorization form

- Constitutional documents for your business

- Submit the documents, visit the ‘Verification’ page, and tick the box for declaration.

- You can submit the application through an electronic verification code, uploading a digital signature certificate, or e-signing.

- Choose the appropriate option and complete the submission. You will receive an Application Reference Number (ARN) on your registered mobile number and email ID.

You can use the ARN to track the status of your GST registration application. Usually, the GST registration certificate is issued within seven days of generating ARN.

The certificate also includes a Goods and Services Tax identification number or GSTIN for freelancers. GSTIN is a unique 15-digit number issued to every taxpayer.

Read: Income Tax for Freelancers in India

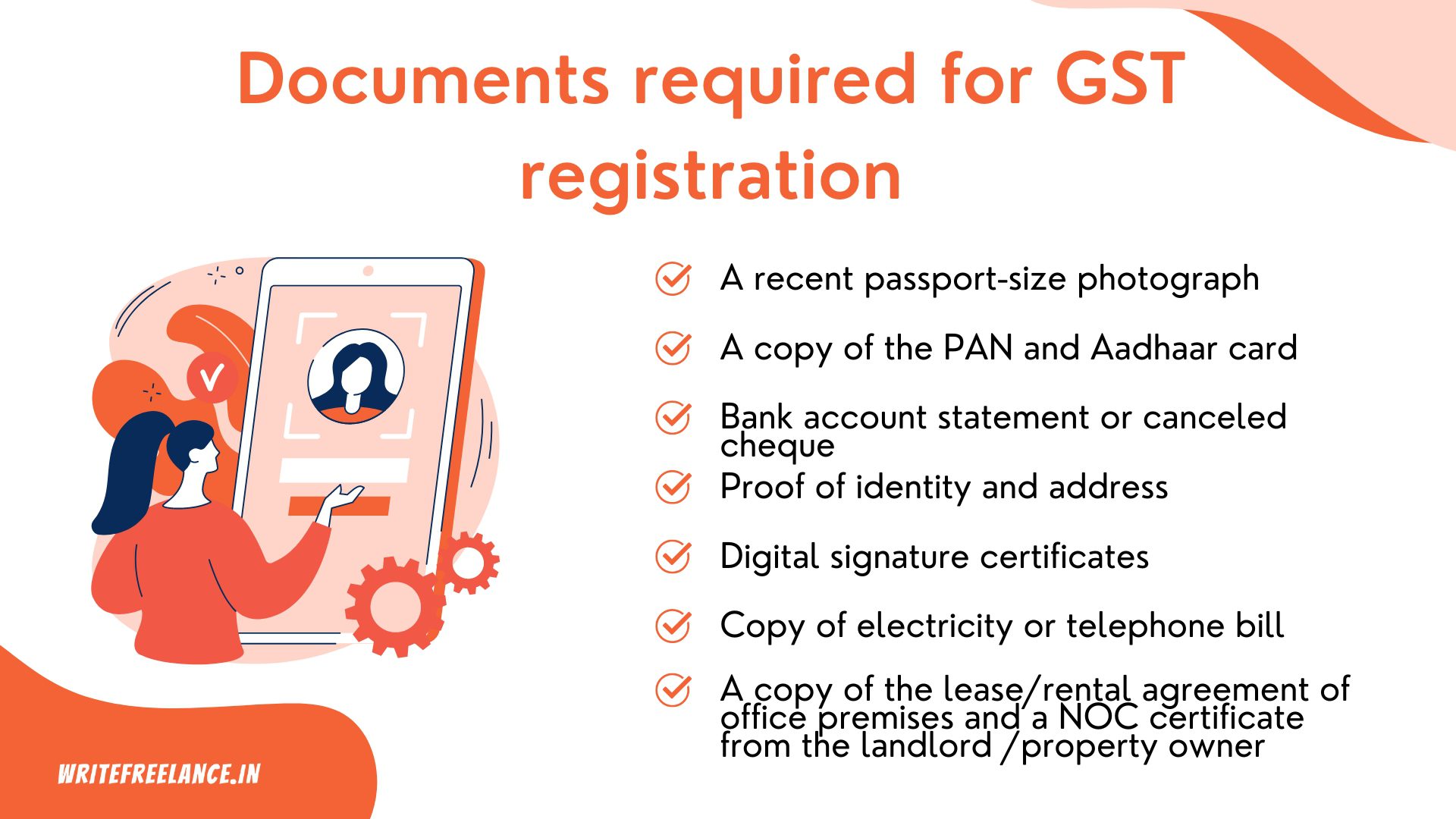

What are the documents required for GST registration?

Here is a list of documents for GST registration for freelancers:

- A recent passport-size photograph

- A copy of the PAN and Aadhaar card of the freelancer

- Latest bank account statement or a canceled cheque

- Proof of identity and address

- Digital signature certificate

- A copy of utility bills such as electricity or telephone

- A copy of the lease/rental agreement of office premises and an NOC certificate from the landlord /property owner/lessor stating that they have no objection to the taxpayer using the premises for conducting business

What happens after GST registration?

Once registered under GST, every invoice you raise should include GST on the total bill amount– which, in the case of freelance writers, B2B SaaS writers, or consultants, will be 18%

For example, if you are billing your client for INR 20,000, the invoice should include GST calculated at 18% and indicate that the total amount payable is INR 23,600.

Make sure that every invoice has a unique number and includes your GSTIN.

Once you receive the payment, you must file your GST return and deposit the GST amount to the government through the GST portal.

Also, note that your client may pay your invoice after deducting TDS for freelancers at 10%. However, their liability to deduct TDS does not affect your right to charge GST. Check out our guide on how to make a freelance invoice to understand how to incorporate GST into your usual invoicing process.

Do I charge GST to overseas clients?

If you provide services to overseas clients and they pay you in any currency other than INR, you have no liability to charge GST.

For example, if you are a freelance writer with clients only in the US, UK, and Australia and your total income when converted is INR 50 lakhs, your GST is 0%. This also applies to GST for freelance work for overseas clients via online marketplaces like Upwork, Fiverr, Freelancer.com, etc.

Ensure to get a foreign inward remittance certificate proving that the payment is indeed in foreign currency, and also make a zero GST filing every month.

But if your overseas client pays you in INR from a bank account in India, you have to charge GST if you are mandatorily or voluntarily registered under GST.

According to CAs, freelancers who exclusively provide services to overseas clients and have an annual turnover of more than INR 20 lakhs should mandatorily register under GST, even though they have no obligation to charge GST from clients.

For instance, if you offer content marketing services only to clients based out of India and paying you through bank accounts registered abroad, you will not be liable to charge them any GST for your services.

Is a freelancer eligible to claim an input tax credit?

Under the GST Act, input tax refers to the goods and services tax that a person pays while purchasing any goods or availing of any service used while running their business. When a person has to pay GST, they can deduct the tax they have already paid for the inputs and only pay the balance.

The GST Act has no special provisions for input tax credit for freelancers. Tax practitioners suggest that freelancers can claim the input tax paid for goods they use for services, provided they are registered under GST. For example, the GST paid on the laptop purchase can be claimed as input credit when the freelancer discharges their GST liability.

If you are an unregistered freelancer, any GST paid on purchasing goods for providing your services will count as a cost.

Conclusion

Whether you are beginning your freelancing journey or a seasoned professional — there is no escaping GST. However, figuring out GST compliance and file returns may look intimidating.

While you can always log on to the GST website and do it all yourself, hiring a chartered accountant who works with freelancers and solopreneurs will ensure that you never find yourself on the wrong side of the law.

FAQs

What are the penalties under GST for freelancers?

Freelancers attract the following penalties if they are liable to register under GST but do not register themselves.

- INR 25,000 for non-registration, and

- INR 100 per day for not filing the returns

Freelancers who register themselves under GST but do not discharge their tax liability or file their returns on time also attract penalties as follows:

- INR 200 per day for late filing of annual returns

- 18% interest per annum, applicable from the next day of the due date, for delayed GST payments

If a freelancer registered under GST doesn’t continuously file returns for six months, their GST registration may be suspended. Such freelancers can only undertake activity once the suspension is revoked.

Do freelancers need to pay GST?

Indian freelancers must pay GST when their turnover exceeds INR 20 lakhs/INR 10 lakhs in special category states) in a financial year.

If a freelancer who doesn’t exceed the specified turnover voluntarily registers under GST, they are also obligated to pay and collect GST and file returns on time.

Do freelancers need to pay both GST and income tax?

GST and Income Tax are separate tax liabilities. Income tax is a direct tax liability, and it is levied on the earnings. GST is an indirect tax liability levied on goods and services provided.

Every freelancer’s income is subject to income tax unless it falls within a salary bracket exempted from paying such tax. This is regardless of their liability to pay GST.

How does the GST affect freelancers?

Like any other service provider, freelancers are also subject to provisions of GST. Usually, a GST of 18% applies to the services provided by freelancers.

If you are a registered freelancer, collecting GST from the service recipients and depositing it with the government can cause cash flow issues. This is due to the lag between receiving the payment and the deadline for depositing the amount to the tax department.

Your freelance income may also get impacted if your customers do not agree to pay GST, forcing you to go out of pocket to discharge the tax liability.

What is the GST exemption limit for freelancers?

Freelancers with an annual turnover of up to INR 20 lakhs/ INR 10 lakhs are exempted from mandatorily registering under GST.